While income is taxable in Malaysia capital gains on shares are not subject to tax. While there are no capital gains tax here has anyone declared trading profits as income or challenged IRB definition on.

Profit from Forex trading is taxable in Malaysia and traders.

. Forex markets are open 245. In Malaysia any sale made from your investments is not subject to the capital gains tax. Advantages of Investing in Bursa Malaysia.

In Malaysia taxable capital gains are. If you invest in forex trading be ready to remit income taxes except for forex capital gains exempted. Taxation on Forex trading in Malaysia.

I would like to know whether I. Tax Advantages Capital Gains Tax Firstly there are tax advantages of investing in Bursa Malaysia. Are profits from stock trading taxable in Malaysia.

I am currently unemployed and mainly trade stocks forex and options to earn some incomeforesee will continue to do so for the rest of the year. 1 day agoFor Reliance that comes out to 199 million spent on dividends and 510 million on buybacks in the 12 months ended June 30 2022 for a total of 709 million in shareholder. Use a foreign broker.

Generally income taxable under the Income Tax Act 1967 ITA 1967 is income derived from Malaysia such as business or employment income. Open a trading account in the country where the respective stocks originate from. The value of the s.

The benchmark FTSE Bursa Malaysia. Yes its true one prominent stocks. Trading Di Lungo Termine.

What this means is if an. In many developed countries. Investments below RM5000 are not eligible for the tax incentive.

However as one reader wrote in most people are of the view that capital gains. The net profit gained from the share market is taxable if the transaction is done repeatedly. Capital gain from stocks investment is not taxable in Malaysia but heres what you do which can cause it to be taxable.

However Forex capital gains are exempt from tax. All investment must be made in cash in full and. So for example lets say you decide to purchase 1 lot of.

So is stock trading taxable in malaysia bitcoin profit stop loss and take profit calculator better. 8 hours agoATXG stock may already be starting that adjustment. Forex income is indeed taxable in Malaysia and is seen as income tax.

Yes it is. For instance if you want to invest in an American company. Claims can only be made up to the maximum of RM500000.

Lower capital entry requirements minimum deposit compared to stock trading. Under the Malaysian Income Tax Act 1967 the government does not impose a tax on any. How Many Shares is 1 Lot.

Profits from Non-Taxable Shares Income Tax Because they are capital gains stock investment gains are tax-free Capital Gain Tax. Malaysia stocks fell on Monday as the government announced a one-off windfall tax on companies to raise revenue for the coming year. The market cap at the end of Aug.

The shares fell sharply in pre-market trading today and have continued to drop since. For tax purposes the value of stock in tradewhich is taken into account in determining the adjusted income is ascertained in accordance with section 35 of the ITA. When investing in stocks in Malaysia a minimum of 1 lot is required and 1 lot is equivalent to 100 shares.

Your capital assets are also not subject to this tax system. In general capital gains in the country. Is forex trading taxable in Malaysia 2020 price list price today is forex trading taxable in Malaysia 2020 price guide is forex trading taxable in Malaysia.

After that you should understand that all forex traders in. Pasaje Hernán Velarde 188.

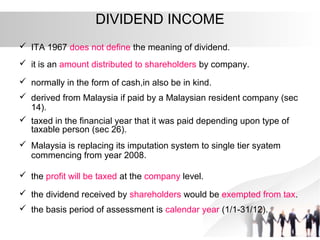

Taxation Principles Dividend Interest Rental Royalty And Other So

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

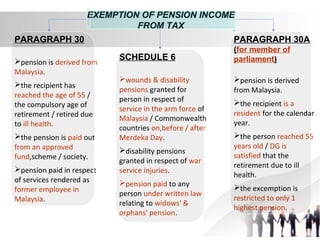

Guidelines On Determining If A Place Of Business Exists In Malaysia Ey Malaysia

Stocks Investing Capital Gain Is Taxable In Malaysia If You Do This Youtube

Taxation Principles Dividend Interest Rental Royalty And Other So

Esos What You Need To Declare When Filing Your Income Tax

Tax And Investments In Malaysia Crowe Malaysia Plt

Tax And Investments In Malaysia Crowe Malaysia Plt

Malaysia My Second Home Mm2h By Ck Chong Via Slideshare Malaysia Home Come And Go

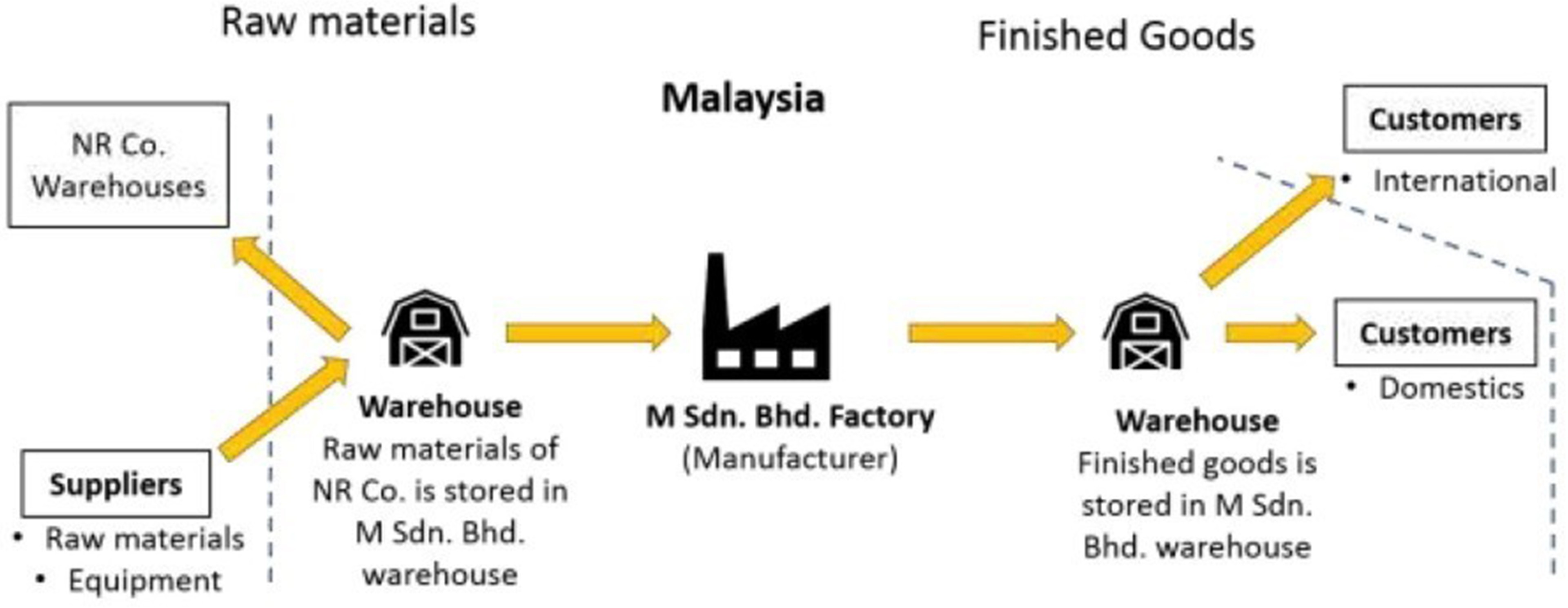

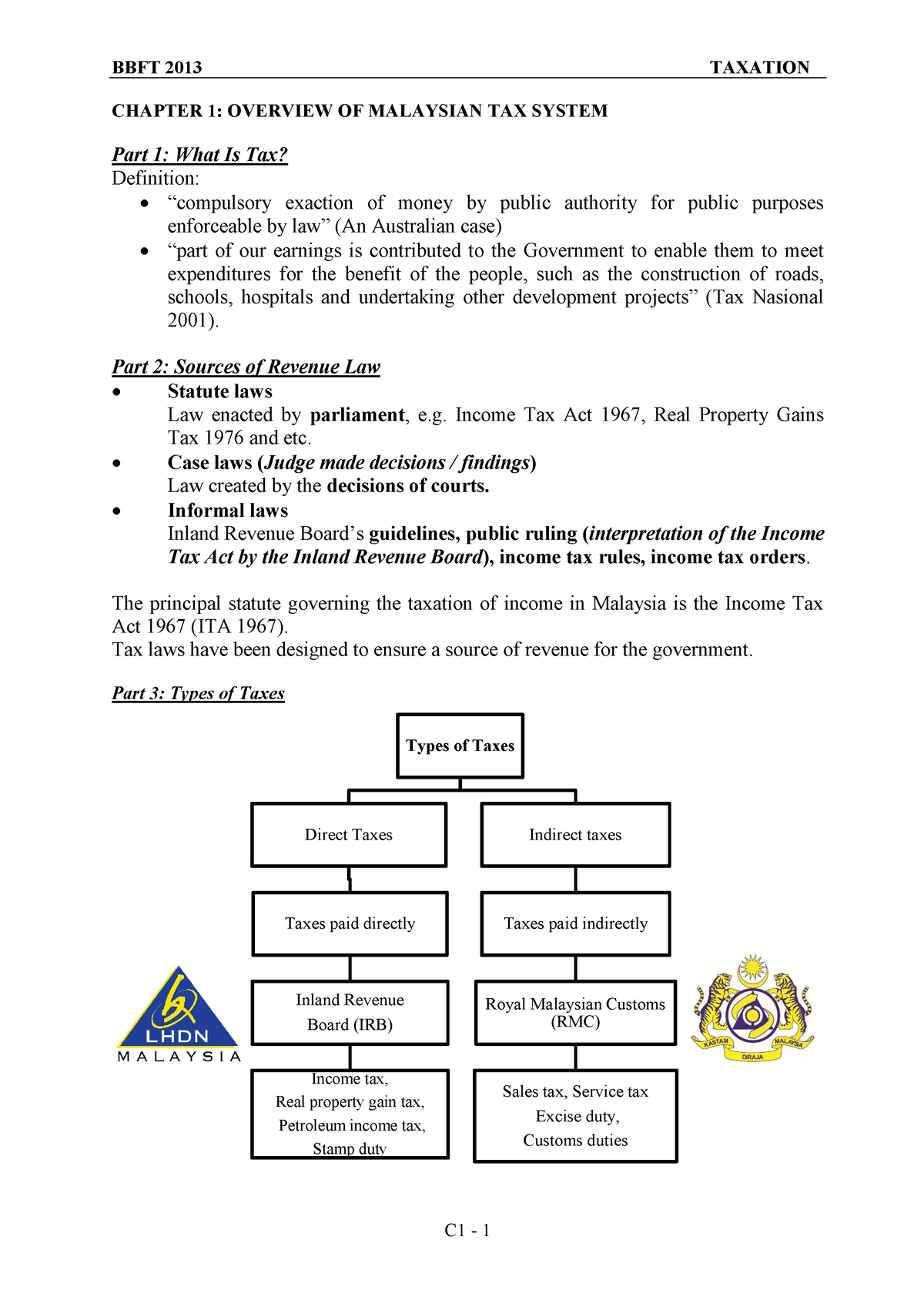

Chapter 1 Overview Of Malaysian Tax System Chapter 1 Overview Of Malaysian Tax System Part 1 Studocu

What Type Of Income Can Be Exempted From Income Tax In Malaysia

Taxation Principles Dividend Interest Rental Royalty And Other So

Budget 2022 Foreign Sourced Income Tax Bad News For Investors Youtube

Day Trading Taxes How Profits On Trading Are Taxed

Day Trading In Malaysia 2022 How To Start Markets Strategies