The revision sees a price hike for a number of models from as low as RM1000 for the GLC 200 to RM33000 for the AMG E 63 S 4Matic. This will be the SST rate that will be implemented from 1st September 2018.

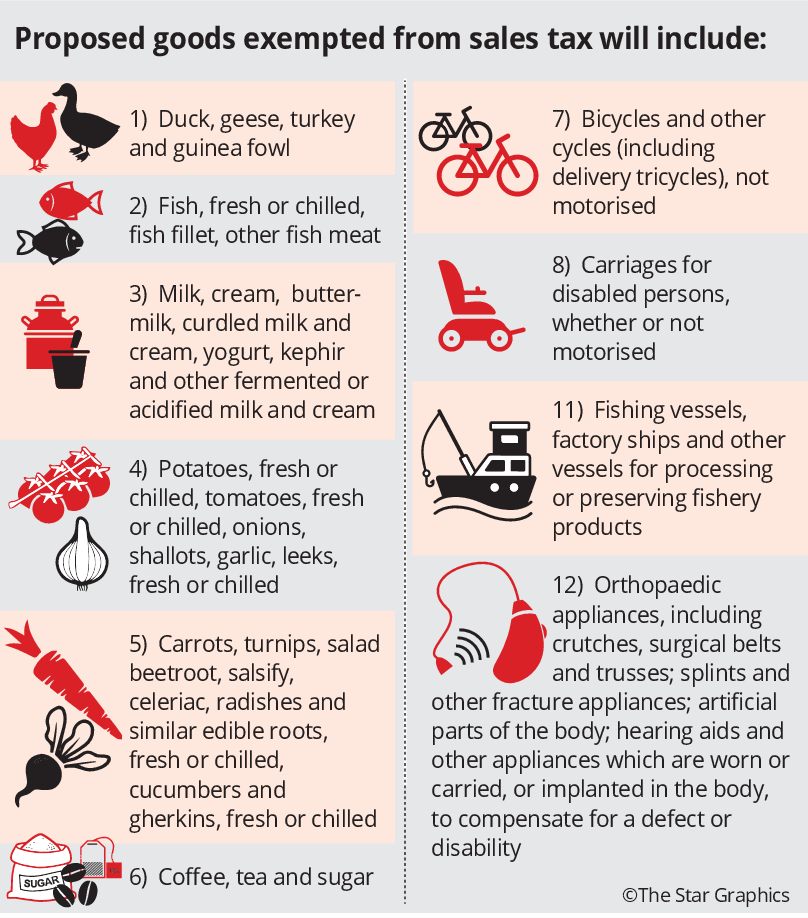

No Sst For Essential Items The Star

2 Overpaid or erroneously paid.

. It was announced on September 1st 2018 that the Sales and Services Tax SST will be reinstated to replace the controversial Goods and Services Tax GST system GST. Declare in Column 13 b 16 In prescribed form JKDM No. However sales tax is not charged on goods and manufacturing activities exempted by Minister of Finance under Sales Tax Goods Exempted From Tax Order 2018 and Sales Tax Person Exempted From Payment of Tax Order 2018.

This announcement contains information about the legal change Sales and Service Tax published by Royal Malaysian Customs Department RMCD. This information is based on legislation and r. Master Exemption List MEL and the importer of such items that is petroleum upstream operator will be given an exemption from sales tax subject to prescribed conditions as stated in the Sales Tax Person Exempted from Sales Tax Order 2018.

Entitle under subsection 356 or 413. Disposed by him and on taxable goods imported into Malaysia. The set rate is 6 percent and some categories of products and services are free from this tax while others are subject to varying rates of taxation.

VAT in Malaysia also known as Sales and Service Tax SST was implemented on September 1 2018 to replace the Goods and Services Tax GST Goods and Services Tax. Effective 1 September 2018 the Malaysian Government has replaced the Goods and Services Tax GST with Sales and Service Tax SST. In this regard Bursa Malaysia Berhad and some of its subsidiaries have been registered for service tax purposes and will start charging 6 service tax on certain fees effective from 1 May 2019.

Operating in Malaysia more than a year. On the National Tax Conference held on 17th July 2018 Malaysias Finance Minster Lim Guan Eng stated that the government will incur a 10 tax on sales of goods and 6 tax on service provision. Malaysia Sales and Service Tax SST will be implemented from September 1 2018.

The sales tax is based on exclusion criteria where all things are taxed by default unless being exempted whereas the service tax is based on inclusion criteria meaning. Sales and Service Tax SST has replaced the Goods and Sales Tax GST on 1st September 2018 in Malaysia. OTHERS Sales of Goods 35.

Jabatan Kastam Diraja Malaysia Kompleks Kementerian Kewangan No 3 Persiaran Perdana Presint 2 62596 Putrajaya 1300 888 500 Pusat Panggilan Kastam 1800 888 855 Aduan Penyeludupan 03-8882 21002300 Ibu Pejabat. What is the SST treatment on goods delivered after 1st September 2018 and payment. Goods are subject to a 5 to 10 sales tax while services are subject to.

Sales Tax Act and Service Tax Act. Section 61A STA 2018. SST consist of 2 separate act.

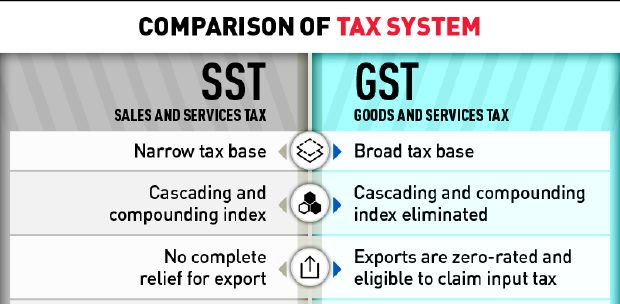

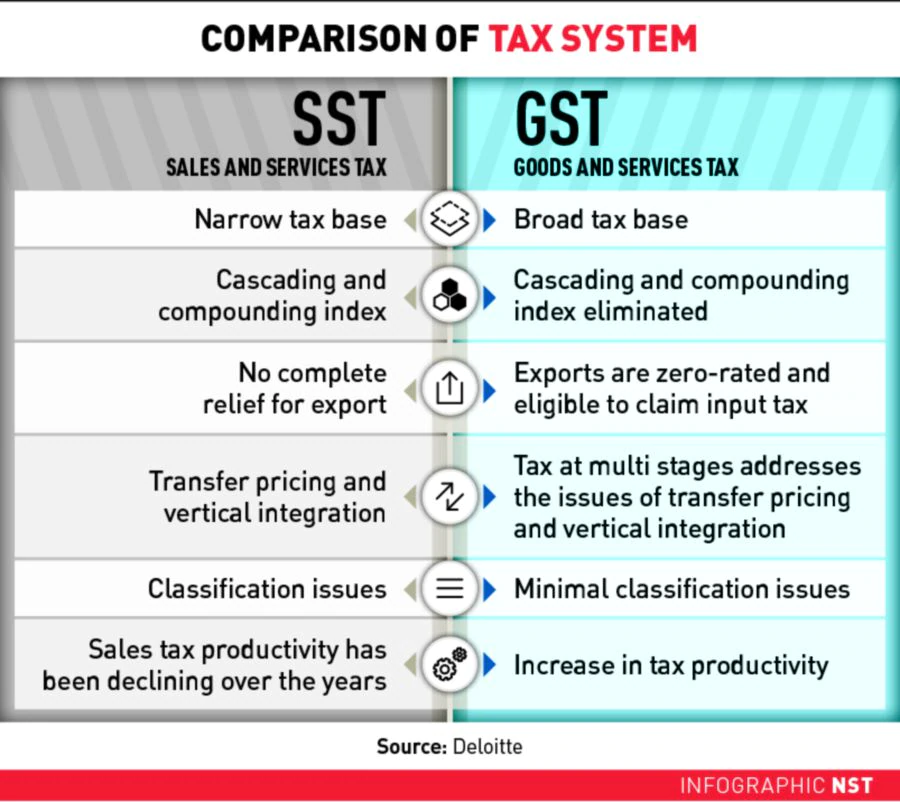

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Gst Better Than Sst Say Experts

Malaysia Sst Sales And Service Tax A Complete Guide

Sst Simplified Malaysian Sales Tax Guide Mypf My

How Is Malaysia Sst Different From Gst

Introduction To Sales And Service Tax Sst Quadrant Biz Solutions

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

Sst Simplified Malaysian Sales Tax Guide Mypf My

Gst Better Than Sst Say Experts

No 10 Drop In Car Prices Despite 10 Sales Tax Exemption Here S Why Wapcar

![]()

Mercedes Benz Malaysia Announces New Sst Price List While Glc Gets Safety Updates

No 10 Drop In Car Prices Despite 10 Sales Tax Exemption Here S Why Wapcar

Goods And Person Exempted From Sales Tax Sst Malaysia

How Is Malaysia Sst Different From Gst

Sst Simplified Malaysian Service Tax Guide Mypf My

![]()

Mercedes Benz Malaysia Announces New Sst Price List While Glc Gets Safety Updates

Sst Simplified Malaysian Sales Tax Guide Mypf My

Introduction To Sales And Service Tax Sst Quadrant Biz Solutions